For the best car lease deals, check out the latest offers from reputable dealerships and compare lease terms and rates. Finding the best car lease deals can save you money and provide you with the opportunity to drive a new vehicle without the long-term commitment of ownership.

In today’s automotive market, consumers have a wide range of options for leasing a vehicle. Whether you’re interested in a compact car, a luxury sedan, or a spacious SUV, there are attractive lease deals available. By exploring different lease terms, mileage allowances, and upfront costs, you can identify the best car lease deals that suit your budget and driving needs.

Additionally, keep an eye out for promotional incentives and special offers from manufacturers and dealerships to maximize your savings. With careful research and negotiation, you can secure a favorable car lease agreement that aligns with your preferences.

Credit: www.realcartips.com

Contents

The Ins And Outs Of Car Leasing

Car leasing can be an attractive option for those who prefer driving a new car every few years without the commitment of ownership. Understanding the ins and outs of car leasing can help you make an informed decision when considering your next vehicle. In this article, we’ll explore the benefits of leasing over buying and common pitfalls to avoid when entering into a car lease agreement.

Benefits Of Leasing Over Buying

1. Lower monthly payments

2. No long-term commitment

3. Ability to drive a new car more frequently

Common Pitfalls To Avoid

1. Exceeding mileage limits

2. Understanding wear and tear policies

3. Being aware of early termination fees

Current Market Trends In Car Leasing

Impact Of Economic Fluctuations

Economic fluctuations have a significant impact on the car leasing market. Low interest rates and favorable economic conditions often lead to increased leasing activity. Conversely, during economic downturns, leasing may become less popular as consumers opt for more financially conservative options.

Lenders and automakers closely monitor economic indicators to adjust lease terms and offers in response to market conditions.

Popular Models And Their Lease Rates

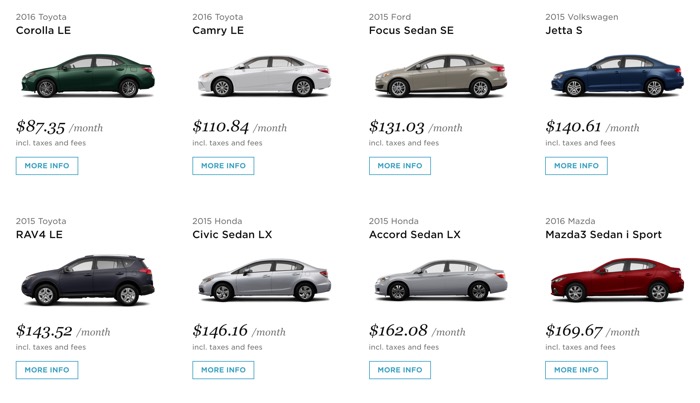

When it comes to popular models, SUVs and sedans are among the most sought-after vehicles for leasing. The lease rates for these models often vary based on factors such as residual value and market demand.

Compact SUVs like the Toyota RAV4 and Honda CR-V typically offer competitive lease rates due to their widespread popularity and strong resale value.

Top Car Lease Deals Of The Year

Looking for the top car lease deals of the year? Check out these fantastic offers that combine luxury, eco-friendliness, and affordability!

Luxury Cars With Affordable Leases

Indulge in luxury without breaking the bank with these top car lease deals:

- Sleek Sedans: Experience elegance with leases starting at $350/month.

- Sporty SUVs: Drive in style with leases as low as $400/month.

Eco-friendly Cars On Great Lease Terms

Go green and save with these eco-friendly car lease options:

- Electric Vehicles: Lease a zero-emission car from $250/month.

- Hybrid Models: Enjoy fuel efficiency with leases starting at $300/month.

Credit: www.autotrader.com

Negotiating Your Lease

Negotiating your lease is important to get the best car lease deals. Research multiple dealerships, know the value of the car, and negotiate the monthly payments and down payment to find the most affordable lease option.

Leasing a car is a popular option for drivers who want to drive a new car without paying the hefty price tag of buying one. However, negotiating a car lease can be a confusing process, especially if you’re not familiar with the terminology. Here are some key terms you should know before you start negotiating your lease:

- Capitalized Cost: This is the price of the car you’re leasing. It’s negotiable, so make sure you try to get the best deal possible.

- Money Factor: This is the interest rate you’ll pay on your lease. The lower the money factor, the better. Make sure you negotiate this rate to get the best deal.

- Residual Value: This is the estimated value of the car at the end of the lease term. The higher the residual value, the lower your monthly payments will be.

- Acquisition Fee: This is a fee charged by the leasing company to start the lease. It’s typically around $500, but it’s negotiable.

- Mileage Allowance: This is the number of miles you’re allowed to drive during your lease term. Make sure you negotiate a mileage allowance that fits your driving habits.

Now that you know the key terms, here are some strategies for lowering your monthly lease payments:

- Negotiate the capitalized cost: As mentioned earlier, the capitalized cost is negotiable. Make sure you negotiate the best price possible to lower your monthly payments.

- Increase the down payment: The more money you put down upfront, the lower your monthly payments will be. Consider putting down a larger down payment if you can afford it.

- Extend the lease term: Extending the lease term will lower your monthly payments, but keep in mind that you’ll be paying more in interest over the life of the lease.

- Choose a higher residual value: Choosing a car with a higher residual value will lower your monthly payments.

- Reduce the mileage allowance: If you don’t drive a lot, consider negotiating a lower mileage allowance to lower your monthly payments.

Remember, when negotiating your lease, it’s important to be prepared and know what you’re getting into. Use these strategies and key terms to help you negotiate the best car lease deal possible.

Credit: www.carfax.com

Frequently Asked Questions

Faq 1: What Are The Best Car Lease Deals Available?

Car lease deals vary depending on the make, model, and location. To find the best deals, consider checking with local dealerships, browsing online marketplaces, and comparing lease offers from multiple sources.

Faq 2: How Can I Get The Lowest Monthly Payment For A Car Lease?

To secure a lower monthly payment for a car lease, you can negotiate the price of the vehicle, consider leasing a car with a higher residual value, and explore any available incentives or discounts offered by the dealership.

Faq 3: What Factors Should I Consider When Leasing A Car?

When leasing a car, it’s important to consider factors such as the lease term, mileage allowance, maintenance and repair costs, insurance requirements, and any additional fees or charges that may apply.

Faq 4: Can I Negotiate The Terms Of A Car Lease?

Yes, you can negotiate the terms of a car lease. Focus on negotiating the price of the vehicle, the money factor (interest rate), lease duration, mileage allowance, and any fees associated with the lease.

Faq 5: What Are The Advantages Of Leasing A Car?

Leasing a car offers several advantages, such as lower monthly payments compared to buying, the ability to drive a new car every few years, reduced maintenance and repair costs, and the option to easily transition to a newer model at the end of the lease term.

Conclusion

Securing the best car lease deals is crucial for saving money and enjoying a new vehicle. By comparing offers and understanding the terms, you can make a savvy choice that suits your needs and budget. Stay informed and proactive to drive away with a great deal.