How much is insurance for a Mustang? The cost of insurance for a Mustang typically ranges from $565 for minimum liability coverage to around $1,540 for full coverage annually. Factors like the driver’s age, location, driving history, and the specific Mustang model can significantly affect the premium.

How much is insurance for a Mustang? The cost of insuring a Ford Mustang can vary significantly based on a variety of factors, including the model year, the trim level, the driver’s age, location, and driving record. As a high-performance vehicle, the Mustang tends to have higher insurance premiums compared to regular sedans, mainly due to its powerful engine and sporty nature. Knowing how these factors affect your insurance rate is important in order to make informed decisions and potentially save on costs.

In this article will provide you with a detailed overview of the average insurance costs for a Mustang, the factors that influence these costs, and tips to help you reduce your premiums.

Contents

How Much Is Insurance for a Mustang?

Insurance costs for a Mustang can vary significantly based on multiple factors, which include your driving profile, the specific Mustang model, and even the state or city where you live. Below we’ll go into detail about these key factors that influence how much you’ll pay for insurance.

1. Driver Age and Experience

One of the biggest factors that affect Mustang insurance rates is your age. Generally, younger drivers tend to pay higher insurance premiums due to the increased risk associated with inexperience on the road. Here’s a breakdown of how age influences Mustang insurance costs:

- 16 years old: On average, young drivers pay about $9,134 annually for Mustang insurance. This is primarily due to the higher risk of accidents associated with inexperienced drivers.

- 20 years old: As drivers mature, their premiums decrease, but they still face high rates, averaging $5,519 per year.

- 30 years old: By this age, drivers typically pay an average of $2,742 per year, thanks to more experience behind the wheel and a cleaner driving record.

- 40 years old: For an experienced driver with no accidents or violations, the cost drops to around $2,572 per year.

- 60 years old: As a senior driver, the insurance cost continues to decrease to about $2,138 annually.

For younger drivers, insurance tends to be more expensive, while rates generally go down as the driver gains more experience.

2. Mustang Model and Trim Level

The model and trim of your Mustang can also impact the insurance cost. Higher-performance models, such as the Mustang GT or Shelby, will usually have higher insurance premiums due to their increased power and higher repair costs in case of an accident. Here’s a breakdown of the typical costs based on Mustang trim:

- Ecoboost Fastback: Costs around $2,206 per year for full coverage.

- GT Premium Convertible: Insurance for this version averages $2,712 per year.

- Dark Horse Premium: A high-performance model like this costs approximately $2,808 annually for full coverage.

On the other hand, more basic models with fewer performance features will have lower insurance premiums.

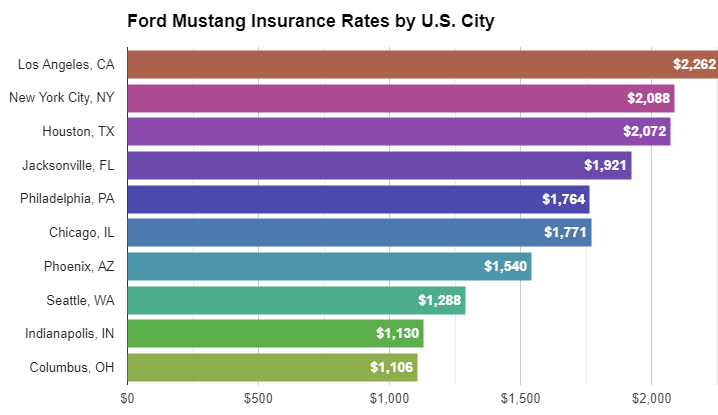

3. Location and Driving Environment

Where you live can play a significant role in the price of your insurance. Areas with higher accident rates, theft, or even expensive repair costs tend to result in higher premiums. Additionally, traffic laws and weather conditions are taken into account by insurers when setting your rate. For example:

- Urban Areas: Cities with heavy traffic and high rates of accidents typically have higher premiums. Areas like Los Angeles or New York might see higher insurance costs for Mustangs.

- Rural Areas: If you live in a quieter, more rural area, you may pay lower insurance premiums due to fewer accidents and lower risk.

In some states, insurance premiums may be higher due to the local regulatory environment. For instance, states like Louisiana tend to have more expensive car insurance due to high accident rates and weather-related risks like flooding.

4. Driving Record and Claims History

Driving history is important when determining how much you’ll pay for insurance. A clean driving record with no accidents or traffic violations will result in a lower insurance rate. However, if you have a history of accidents, speeding tickets, or DUI offenses, your premiums are likely to be higher. Insurers see you as a higher-risk driver, so they charge more for coverage.

If you’ve been involved in accidents in the past, you may face a surcharge on your insurance, sometimes lasting several years. Similarly, filing multiple claims can increase your insurance rates as insurers consider you a more likely claimant.

5. Credit Score and Vehicle Usage

Insurers often use credit scores to assess the risk of a driver. Studies show that individuals with higher credit scores tend to file fewer claims, so they receive lower rates. If your credit score is lower, you may face higher premiums.

Also, how often and how far you drive can influence your premiums. For example, if you’re using your Mustang as a daily commuter vehicle, you may pay more than someone who only drives it on weekends or for recreational purposes.

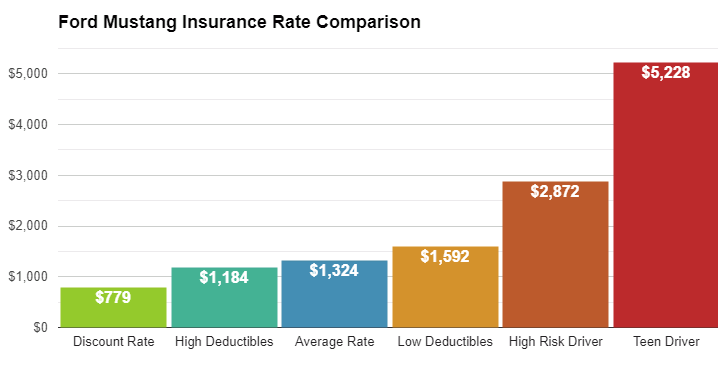

6. Type of Coverage and Deductibles

The type of coverage you select and the deductible amount you’re willing to pay will also impact your insurance rates. Full coverage insurance typically costs more than liability insurance, as it covers both damage to your car and any damage you cause to others.

- Full coverage: Includes collision, comprehensive, and liability coverage. The average cost is around $1,540 annually for a 40-year-old driver with a clean driving record.

- Liability coverage: This only covers damage to other drivers’ property and injuries you cause. It’s cheaper, with an average cost of around $565 per year for the same driver.

Additionally, increasing your deductible can lower your premium but means you’ll have to pay more out of pocket if you make a claim.

Average Mustang Insurance Costs by Model Year

Insurance rates can also vary based on the model year of your Mustang. Here’s a general idea of what you can expect for Mustang insurance costs based on the year:

| Model Year | Full Coverage Cost |

|---|---|

| 2022 | $1,869/year |

| 2021 | $1,843/year |

| 2020 | $1,811/year |

| 2019 | $1,786/year |

| 2018 | $1,753/year |

| 2017 | $1,669/year |

| 2016 | $1,583/year |

| 2015 | $1,498/year |

| 2014 | $1,435/year |

| 2013 | $1,371/year |

Older Mustang models generally have lower insurance costs due to their lower value and the fact that replacement parts are typically less expensive.

Tips to Lower Insurance for a Mustang

If you’re looking to save on Mustang insurance, consider the following tips:

- Increase your deductible: If you’re willing to pay a higher deductible, you can lower your monthly premium.

- Bundle insurance policies: Many insurers offer discounts if you bundle auto insurance with other policies such as home or renters insurance.

- Take a defensive driving course: Some insurers offer discounts to drivers who complete a defensive driving course.

- Install safety and anti-theft devices: Features like anti-theft systems, airbags, and parking sensors can lower your premium.

- Shop around: Compare insurance quotes from different providers to find the best rates for your specific needs.

Frequently Asked Questions

Here are some FAQs about insurance for a mustang –

1. Why is Mustang insurance so expensive?

Insurance for a Mustang tends to be more expensive due to the car’s high-performance nature. High-performance vehicles have increased repair costs, higher risk for accidents, and often cost more to replace or repair after an accident. Additionally, some Mustang models, like the GT or Shelby, have larger engines, which also contribute to higher premiums.

2. How can I find the cheapest insurance for my Mustang?

To find the best insurance rates, compare quotes from multiple providers. Consider adjusting your coverage options or raising your deductible to lower premiums. Also, keep your driving record clean and take advantage of discounts for safety features or bundling policies.

3. Does the color of my Mustang affect my insurance rates?

No, the color of your Mustang does not affect your insurance rates. Insurers base their rates on factors like the car’s model, engine size, and safety features, not the color.

4. Are there discounts available for Mustang owners?

Yes, many insurers offer discounts for various reasons, including good driving history, anti-theft devices, and safety features like airbags and parking sensors. Bundling multiple policies with the same insurer can also lead to discounts.

5. Does the trim of the Mustang influence my insurance rate?

Yes, higher trims such as the Shelby GT500 or Mustang GT typically cost more to insure due to their powerful engines and high performance. More basic models like the Ecoboost tend to have lower insurance rates.

Conclusion

The cost of insurance for a Ford Mustang depends on a variety of factors, including the driver’s age, driving history, location, and the specific model of the Mustang. By understanding these factors, you can take steps to reduce your premiums. Remember, comparing quotes from different providers and choosing the right coverage options is key to getting the best deal on your Mustang insurance.